Late in 2020, the Internal Revenue Service (IRS) announced a plan to increase audits of small businesses and their investors by 50% in 2021 and, in a sign that they are serious, put hiring plans in motion to add the capacity.

To be clear, the rate of audits of small businesses has been quite low in recent years, so the increase, while meaningful, doesn’t mean you are assured of being audited. However, your business could be chosen for audit solely by statistical algorithms, or could be flagged because of doing business with someone who is under audit (including an investor/partner/member).

The targeted taxpayers are mostly “pass through entities” including LLCs, LLPs, Subchapter S corporations, and partnerships. It should be noted as well that 2015 legislation made it possible for the IRS to collect underpaid taxes from such entities themselves rather than only chase the partners/members, meaning the business entity itself is at risk now if an audit finds underpaid taxes.

Now, you’re probably thinking, “Well, that’s just dandy. So what do I do now?”

The last few years have seen a bewildering array of changes in tax laws, so what might be a “red flag” that draws attention today versus yesteryear is probably unknowable. Our suggestion: Focus on what you can do be prepared if that audit algorithm picks you at random.

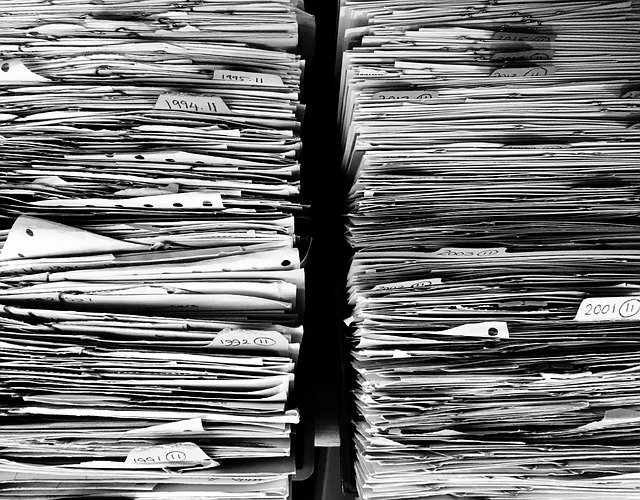

The law requires you keep all records relating to tax returns for three years and the IRS usually only audits returns filed in the last three year (more often within the last two years) but if the IRS auditor identifies substantial errors, you might have to provide earlier records.. The auditor may request records such as receipts, bills, cancelled checks, legal papers, loan agreements, logs/diaries, tickets, medical/dental records, theft/loss documents, employment documents (including employee policies), K-1s, and whatever else is relevant to your tax return.

What we strongly suggest is to use your tax preparation as a chance to organize your business records so that you know if you are missing any vital substantiation of expenses or inadvertently underreported income. If you start with the proverbial shoe box of receipts, don’t just dump them back in there after you file your return. Instead, file them physically in an organized manner that cross-references your return (e.g. keep inventory records together and separate from your auto expenses) or, better yet, enter everything into bookkeeping software with scans of the records attached.

If the worst-case scenario happens and that audit letter hits your mailbox, you’ll be ready to deal with it rather than scrambling in a panic. The side benefit is that you will know how your business really performed, have a clearer view of how to manage going forward, and have the basis for ongoing record keeping that will make next tax season easy and your return able to withstand scrutiny.

If you operate your business from your home, chances are high that you’ve been considering how to deduct the use of your home space on your taxes. The good news: The Internal Revenue Service offers home office deductions for business owners who don’t own or rent space for business operations. The bad news: Those deductions are subject to specific definitions of what qualifies as a “home office”.

If you operate your business from your home, chances are high that you’ve been considering how to deduct the use of your home space on your taxes. The good news: The Internal Revenue Service offers home office deductions for business owners who don’t own or rent space for business operations. The bad news: Those deductions are subject to specific definitions of what qualifies as a “home office”.

“OK, you’ve

“OK, you’ve