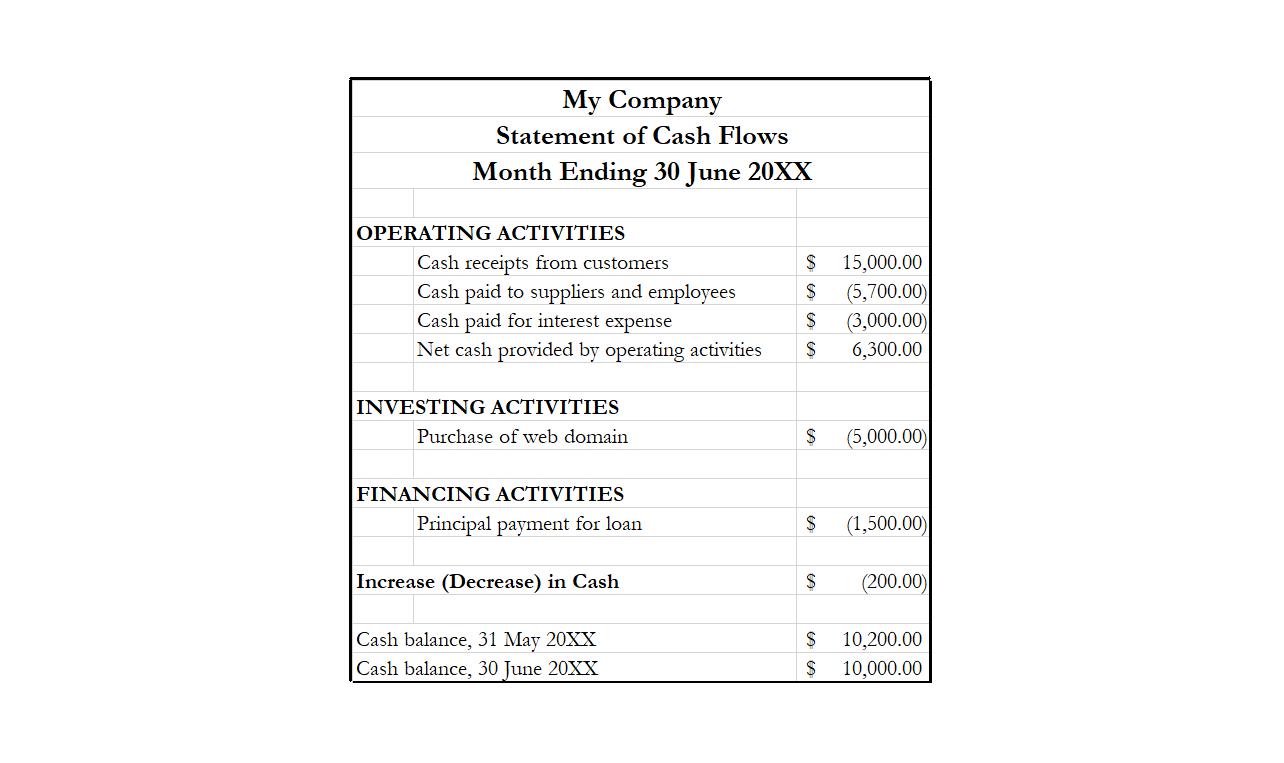

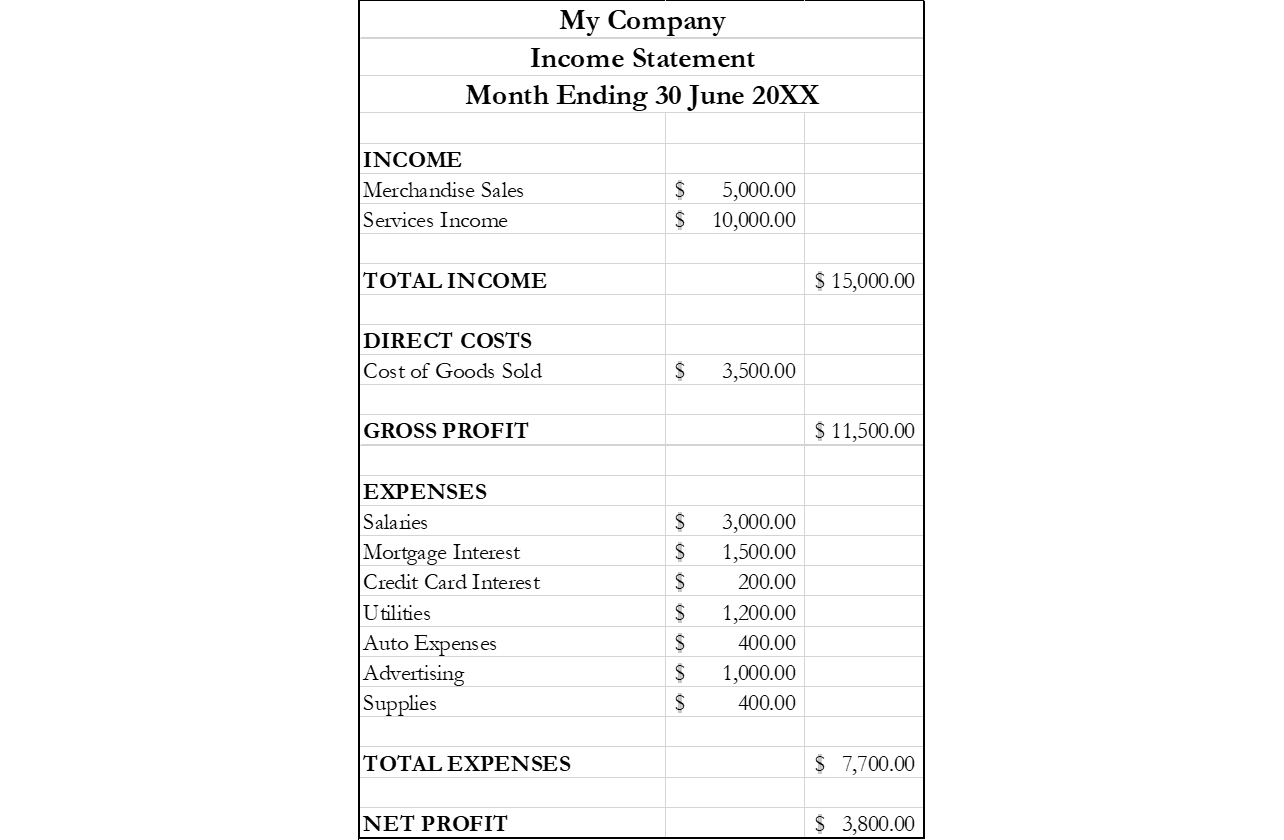

My net profit on my monthly income statement looked great, but my checking account balance is a LOT lower. How did that happen?

In an earlier post, I explained why “checkbook bookkeeping” is a less-than-optimal method of tracking your business’s financial health. You might think you have more money to spend because you haven’t considered future withdrawals.

However, the same checkbook balance that creates a false sense of having lots of cash available can also create a false sense of having cash problems.

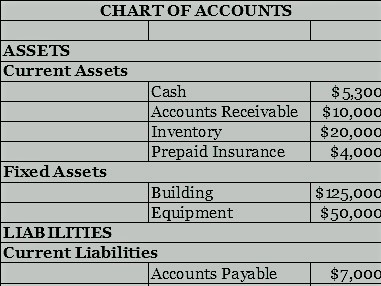

That’s because these transactions actually aren’t part of the income statement. They might be money flowing in and out of your business, but instead of creating revenue and expenses, they actually reside on the balance sheet as assets, liabilities or equity:

- Inventory Purchases – Inventory that you purchase to resell to customers at a profit is considered an asset, not an expense.

- Paying Last Month’s Bills – If your service vendors allow you time to pay bills (usually 15 or 30 days), then the bill you are paying this month might technically have been part of last month’s income statement, but are part of this month’s balance sheet.

- Paying Out Tips to Employees or Taxes Collected for Payroll or Sales – Money you collect for employee tips,payroll and sales tax isn’t considered income, which means the money you pay isn’t considered an expense.

- Paying Yourself via Owner’s Draw – If your business structure requires an owner’s draw to pay yourself, that withdrawal is taken from the equity you have in the company instead of as a salary expense.

It’s essential that you, as the business owner, know how different transactions affect your business. In addition to your “cash in the bank”, the profit margin and the equity are both important to understanding your business’s financial health.

Questions or comments? Let us know below!

“I need to buy a gift for my kid’s birthday. Is it okay to write a check from my company’s bank account to pay the toy shop?”

“I need to buy a gift for my kid’s birthday. Is it okay to write a check from my company’s bank account to pay the toy shop?” “Okay, I’ve got that box of receipts, vendor bills, loan docs, paid invoices … so what goes where?”

“Okay, I’ve got that box of receipts, vendor bills, loan docs, paid invoices … so what goes where?”